The time leading up to retirement is exciting – and crucial for planning the next phase of your life.

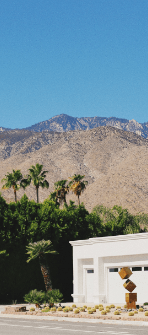

During this time, you can finally see the light at the end of the tunnel, and you’re likely making plans to spend more time with loved ones, enjoy your hobbies, travel more, or even start the new business you have always wanted to pursue.

The time leading up to retirement is exciting – and crucial for planning the next phase of your life.

During this time, you can finally see the light at the end of the tunnel, and you’re likely making plans to spend more time with loved ones, enjoy your hobbies, travel more, or even start the new business you have always wanted to pursue.

But before you make the break from your employer, there are many plans to be made. That’s because generating enough income from your savings, retirement plan, or Social Security can have a tremendous bearing on the retirement lifestyle you are ultimately able to live.

With this in mind, making a plan sooner rather than later can show you where any possible gaps may be – and allow you more time to fill them in.

The good news is there are strategies you can use to ensure a set amount of income for the remainder of your life – regardless of how long it may be. You can also put a guaranteed income stream in place for a spouse or other loved one – no matter what occurs in the market, or even in the economy, or your health.

Don’t wait until the day you retire to find out whether you have an income shortfall. Meet with us and we’ll help you determine how much retirement income you’ll have and what to do if it won’t be enough.

But before you make the break from your employer, there are many plans to be made. That’s because generating enough income from your savings, retirement plan, or Social Security can have a tremendous bearing on the retirement lifestyle you are ultimately able to live.

With this in mind, making a plan sooner rather than later can show you where any possible „gaps” may be – and allow you more time to fill them in.

The good news is there are strategies you can use to ensure a set amount of income for the remainder of your life – regardless of how long it may be. You can also put a guaranteed income stream in place for a spouse, or other loved one – no matter what occurs in the market, or even in the economy, or your health.

Don’t wait until the day you retire to find out whether you have an income shortfall. Meet with us and we’ll help you determine how much retirement income you’ll have and what to do if it won’t be enough.